Mortgage under Transfer of Property Act, 1882

Table of Contents

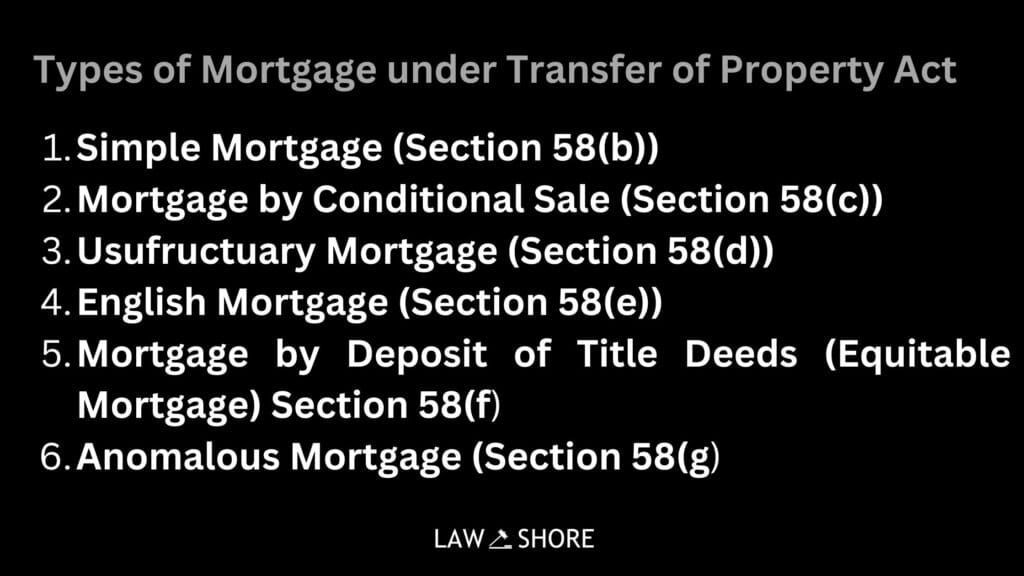

ToggleThe Act outlines six types of mortgages under Transfer of Property Act. Below is a detailed examination of each type, including illustrations and case laws. The Transfer of Property Act, 1882 governs the law relating to the transfer of property in India. Mortgages are an essential legal mechanism under the Act, allowing borrowers to secure loans by offering immovable property as collateral. The Act classifies mortgages into six distinct types, each suited to different situations. This article explores the meaning of a mortgage, its types, and relevant case laws with illustrations.

What is a Mortgage?

A mortgage is defined under Section 58 of the Transfer of Property Act, 1882 as the transfer of an interest in specific immovable property by the owner (mortgagor) to another person (mortgagee) for the purpose of securing:

1. The repayment of a loan, or

2. The performance of an obligation.

Illustration

Suppose A needs a loan of ₹10,00,000 to expand his business. To secure this loan, A mortgages his house as collateral to B, a lender. A and B enter into a legal agreement where:

• A remains the owner of the house.

• B gains the right to sell the house if A fails to repay the loan within the agreed time.

In this case, A is the mortgagor, B is the mortgagee, the house is the mortgaged property, and the loan of ₹10,00,000 is the secured debt. Upon repayment of the loan, A’s interest in the house is restored.

The key elements of a mortgage under Transfer of Property Act

Parties to the Mortgage

• Mortgagor: The person who transfers the property to secure the loan (borrower).

• Mortgagee: The person or institution to whom the property is transferred as security for the debt (lender).

Debt or Obligation

A mortgage involves a loan or obligation that is secured by the transfer of the property. The mortgagor borrows money or takes a loan, and the property serves as collateral for that debt.

Transfer of Interest

The mortgagor transfers an interest in the property to the mortgagee. The nature of the interest transferred varies depending on the type of mortgage (e.g., legal or equitable).

Immovable Property

Only immovable property (such as land or buildings) can be mortgaged under the Act. Movable property cannot be transferred in the same way to secure a debt under the provisions of this Act.

Conditions of Mortgage

The mortgage agreement includes the conditions under which the property is mortgaged, such as the amount of the loan, the repayment schedule, the rate of interest, and the rights and obligations of both parties.

Right of Redemption

The mortgagor retains the right to redeem the property by repaying the debt within a specified time. This right is a fundamental feature of mortgages in Indian law and is a key protection for the borrower.

Equity of Redemption

The mortgagor’s right to redeem the property even after defaulting on the loan, provided they act within the stipulated time and fulfill the terms of the mortgage.

Right of Sale

If the mortgagor defaults on the repayment of the loan, the mortgagee may have the right to sell the mortgaged property (in certain types of mortgages like a power-of-sale mortgage), as outlined in the mortgage agreement.

These elements ensure that the mortgage is legally binding, and they govern how the rights of both the mortgagor and mortgagee are handled in case of default or dispute.

Types of Mortgage under Transfer of Property Act

The Act outlines six types of mortgages. Below is a detailed examination of each type, including illustrations and case laws.

Simple Mortgage (Section 58(b))

In a simple mortgage, the borrower (mortgagor) creates a personal obligation to repay the loan without transferring possession of the property. If the borrower defaults, the lender can file a suit to sell the mortgaged property.

Illustration: A borrows ₹10,00,000 from B and executes a deed stating that in case of default, B can sell A’s house and recover the loan. A retains possession of the house. This is a simple mortgage.

Case Law: Sundarachari v. Narayana Ayyar (1902)

Key Points:

- A simple mortgage allows the lender (mortgagee) to sell the mortgaged property in case of default by the borrower (mortgagor), without the need to take possession of the property.

- The lender’s right to sell the mortgaged property is a legal right and is enforceable by law.

- The decision clarifies that in a simple mortgage, the lender’s right to sell is independent of possession, unlike other mortgage types.

Facts of the Case:

- The case involved a simple mortgage where the borrower (Narayana Ayyar) had mortgaged property to the lender (Sundarachari).

- The borrower defaulted on the repayment, and the lender sought to exercise his right to sell the mortgaged property to recover the loan amount.

- The borrower contested the lender’s action, raising issues about the nature of the mortgage and the lender’s rights.

Findings of the Court:

- The court held that under a simple mortgage, the lender has the right to sell the mortgaged property if the borrower defaults, without the need for possession.

- The court clarified that the lender’s right to sell arises directly from the mortgage agreement and does not require the lender to take physical possession of the property.

- The judgment upheld the validity of the lender’s action, reinforcing the legal distinction between simple mortgages and other forms of mortgages.

The court clarified that in a simple mortgage, the lender has a legal right to sell the property without taking possession.

Mortgage by Conditional Sale (Section 58(c))

Here, the property is ostensibly sold to the mortgagee with a condition that the sale becomes void upon repayment or absolute upon default.

Illustration: C borrows ₹5,00,000 from D and executes a sale deed for his land in favor of D, with a condition that the sale will be void if C repays the loan within two years. If C fails, the sale becomes absolute. This is a mortgage by conditional sale.

Case Law: Chunchun Jha v. Ebadat Ali (1954):

Key Points:

- A mortgage by conditional sale occurs when a sale is intended to secure a loan, even if the sale appears to be absolute.

- The Supreme Court clarified that intention behind the transaction matters more than the form of the document.

- A sale that secures a debt but is described as an absolute sale will be treated as a mortgage by conditional sale if it was intended to operate as security for a loan.

Facts of the Case:

- The case involved a transaction where property was sold by the borrower to the lender.

- The sale was ostensibly an absolute sale but was, in reality, intended to secure a loan, with a condition that the property would be reconveyed once the loan was repaid.

- The borrower later contested the transaction, arguing that the sale was a mortgage by conditional sale, not an outright sale.

Findings of the Court:

- The Supreme Court held that, despite the appearance of an absolute sale, the transaction was in substance a mortgage by conditional sale, as it was made to secure a loan.

- The court emphasized that the intention of the parties at the time of the transaction is crucial in determining whether the sale is a genuine transfer or merely a security arrangement.

- The Court ruled that the transaction would be governed by the provisions related to mortgage by conditional sale under the Transfer of Property Act, 1882, and not as an absolute sale.

The Supreme Court held that when a sale is intended to secure a loan, it constitutes a mortgage by conditional sale, even if it appears as an absolute sale.

Usufructuary Mortgage (Section 58(d))

In this type, the mortgagor delivers possession of the property to the mortgagee. The mortgagee earns income from rents or profits of the property in lieu of interest or principal repayment.

Illustration: E borrows ₹3,00,000 from F and delivers possession of his orchard to F. F collects the income from the orchard to recover the loan amount. This is a usufructuary mortgage.

Case Law: Thakar Barmha v. Sardar Singh (1902):

Key Points:

- A usufructuary mortgage only grants the mortgagee the right to use the income or profits from the mortgaged property, not the right to foreclose or sell the property.

- The mortgagee’s rights are limited to enjoying the property’s income until the debt is repaid.

- The case clarified the distinction between usufructuary mortgages and other types of mortgages, especially regarding the extent of the mortgagee’s powers.

Facts of the Case:

- The case involved a dispute between Thakar Barmha (the mortgagor) and Sardar Singh (the mortgagee) regarding the rights of the mortgagee under a usufructuary mortgage.

- The mortgagee, Sardar Singh, sought to exercise rights over the mortgaged property beyond the income, possibly looking to foreclose or sell the property due to non-payment.

- The mortgagor contested the mortgagee’s right to foreclose or sell the property, arguing that only the income could be used to satisfy the debt.

Findings of the Court:

- The Privy Council ruled that a usufructuary mortgage does not grant the mortgagee the right to sell or foreclose the property.

- The court emphasized that the mortgagee’s rights are limited to appropriating the income or profits from the property until the debt is repaid, and they do not extend to the right of sale or foreclosure.

- The ruling reinforced the principle that usufructuary mortgages are distinct from other mortgage types, where the mortgagee may have the right to sell the property.

The Privy Council emphasized that a usufructuary mortgage only grants the mortgagee the right to use the property’s income and not the right to foreclose or sell it.

English Mortgage (Section 58(e))

In an English mortgage, the mortgagor transfers ownership of the property to the mortgagee, with a condition that ownership will revert upon full repayment of the loan by a specific date.

Illustration: G borrows ₹8,00,000 from H and transfers ownership of his house to H. They agree that ownership will revert to G upon repayment. This is an English mortgage.

Case Law: Narandas Karsondas v. S.A. Kamtam (1977):

Key Points:

- An English mortgage requires strict compliance with the agreed repayment terms for the reversion of ownership to the mortgagor.

- The court emphasized that the mortgagee (lender) has a right to foreclose the property if the mortgagor fails to repay as per the terms of the mortgage.

- The ruling highlighted the legal consequences of non-compliance with the terms, especially concerning the transfer of property ownership in an English mortgage.

Facts of the Case:

- The dispute arose from an English mortgage, where the mortgagor (Narandas Karsondas) had borrowed money by transferring the property to the mortgagee (S.A. Kamtam) with a condition for reversion of ownership upon repayment.

- The mortgagor failed to repay the loan in accordance with the agreed terms.

- The mortgagee sought to enforce the terms of the mortgage, including the right to retain or sell the property due to non-compliance with the repayment schedule.

Findings of the Court:

- The Supreme Court ruled that, in an English mortgage, the mortgagor must strictly comply with the repayment terms to regain ownership of the property.

- The court emphasized that failure to meet the agreed repayment conditions allows the mortgagee to foreclose or retain ownership of the property.

- The judgment reinforced the legal requirement for clear adherence to the mortgage agreement, particularly concerning the reversion of property and the mortgagee’s right to sell in case of default.

The Supreme Court ruled that an English mortgage requires strict compliance with the agreed repayment terms for ownership reversion.

Mortgage by Deposit of Title Deeds (Equitable Mortgage) (Section 58(f))

An equitable mortgage is created when the borrower deposits title deeds with the lender to secure a loan. This type is common in urban areas and does not require registration.

Illustration: I borrows ₹15,00,000 from J and deposits the title deeds of his flat as security. This constitutes an equitable mortgage.

Case Law: K.J. Nathan v. S.V. Maruthi Rao (1965):

Key Points:

- The mere deposit of title deeds with the intent to secure a loan creates a valid equitable mortgage under Indian law.

- Intention to secure the loan is critical in determining the existence of an equitable mortgage, regardless of formal documentation.

- The Supreme Court emphasized that the deposit of title deeds, along with the clear intent to use the property as security for the loan, is sufficient to constitute an equitable mortgage.

Facts of the Case:

- K.J. Nathan (the borrower) deposited the title deeds of his property with S.V. Maruthi Rao (the lender) to secure a loan.

- There was no formal written agreement explicitly creating a mortgage, but the lender accepted the title deeds as security for the loan.

- The issue arose when the borrower contested the validity of the mortgage, arguing that a formal document was required to create a valid mortgage.

Findings of the Court:

- The Supreme Court ruled that the deposit of title deeds with the intention of securing a loan is enough to create a valid equitable mortgage, even in the absence of a formal mortgage document.

- The Court held that the intent of the parties and the delivery of title deeds were sufficient to establish the mortgage, and it did not require a formal written agreement.

- The ruling clarified the concept of equitable mortgages in India, recognizing the deposit of title deeds as a valid and enforceable method of creating a mortgage when there is an intention to secure a loan.

The Supreme Court held that a mere deposit of title deeds with intent to secure a loan creates a valid equitable mortgage.

Anomalous Mortgage (Section 58(g))

An anomalous mortgage is a combination of two or more types of mortgages or one that does not fall within the categories above.

Illustration: K borrows ₹7,00,000 from L and agrees to transfer possession of his property while also granting L the right to sell it if K defaults. This is an anomalous mortgage.

Case Law: Gauri Shankar v. Murlidhar (1917)

Key Points:

- The court clarified that an anomalous mortgage must have clear and definite terms that align with the general principles of contract law.

- An anomalous mortgage refers to a mortgage that does not strictly conform to the traditional forms under the Transfer of Property Act but still operates as a valid mortgage.

- The terms of the mortgage must be enforceable, meaning they must be explicit and unambiguous for the mortgage to be legally binding.

Facts of the Case:

- The dispute arose from a mortgage agreement that did not conform to any of the traditional categories of mortgages under the Transfer of Property Act, i.e., it was an anomalous mortgage.

- Gauri Shankar (the mortgagor) entered into a mortgage agreement with Murlidhar (the mortgagee), which did not fully align with the formal categories like simple or usufructuary mortgages.

- The issue was whether such an anomalous mortgage could still be valid and enforceable, given its non-standard terms.

Findings of the Court:

- The court held that an anomalous mortgage is valid, but its terms must be clear and definite, and they must comply with general contract principles.

- The court emphasized that even in an anomalous mortgage, the intent of the parties and the terms of the agreement must be clear enough to ensure that the agreement is enforceable.

- The judgment reinforced the idea that while mortgages can be flexible, the essential elements of a valid contract—such as clarity, mutual consent, and lawful consideration—must be present for the mortgage to hold legal force.

Here is a tabular differentiation between the six types of mortgages under the Transfer of Property Act, 1882:

| Type of Mortgage | Definition | Possession | Right to Sale | Key Features |

|---|---|---|---|---|

| 1. Simple Mortgage (Section 58(a)) | The borrower mortgages property to the lender without transferring possession but agrees to pay the debt. | Borrower retains possession. | Lender has the right to sell the property in case of default, but without possession. | The mortgagor retains possession; the mortgagee can foreclose or sell the property if the borrower defaults. |

| 2. Mortgage by Conditional Sale (Section 58(b)) | The borrower sells the property to the lender with a condition that the sale will be void if the loan is repaid. | Borrower retains possession. | Lender has the right to sell in case of default but only if the condition is not met. | The sale is not final but contingent on repayment; if the borrower defaults, it operates as a mortgage. |

| 3. Usufructuary Mortgage (Section 58(c)) | The borrower transfers possession of the property to the lender, who can use the property to recover the debt. | Lender gets possession. | The lender can retain possession and appropriate the income from the property for repayment. | Lender receives rents and profits from the property and can retain possession until the debt is repaid. |

| 4. English Mortgage (Section 58(d)) | The borrower transfers property to the lender with an agreement to repay the debt on a specified date, failing which the lender can sell the property. | Borrower initially retains possession. | Lender can sell the property if the debt is not repaid as per the agreement. | It involves transfer of property to the lender with a condition for repurchase; failure to repay leads to sale. |

| 5. Mortgage by Deposit of Title Deeds (Section 58(f)) | The borrower deposits the title deeds of the property with the lender as security for a loan. | Borrower retains possession. | Lender can sell the property if the debt is not repaid, but the mortgage is created by the deposit of documents. | Title deeds are deposited as security, and the transaction is recognized as a mortgage without physical transfer. |

| 6. Reverse Mortgage (Section 58(g)) | The lender makes periodic payments to the borrower (usually elderly), and the property is transferred upon the borrower’s death. | Borrower retains possession. | Upon death of the borrower, the lender has the right to sell the property. | Used for senior citizens; lender pays loan amounts to the borrower, who continues to live in the property. |

Summary of Key Differences

Possession: In some mortgages, possession of the property remains with the borrower (e.g., Simple Mortgage, Mortgage by Deposit of Title Deeds), while in others, possession is transferred to the lender (e.g., Usufructuary Mortgage, English Mortgage).

Right to Sale: In most mortgage types, the lender has the right to sell the property in case of default, but the conditions and method of execution vary. For instance, a Simple Mortgage doesn’t require possession for the lender to sell, whereas a Usufructuary Mortgage grants the lender possession and control of the property until repayment.

Nature of Transaction: Some mortgages, like Mortgage by Conditional Sale, appear as sales but are conditional and function as a mortgage. Others, such as Reverse Mortgages, are designed for specific purposes like senior citizen welfare.

Conclusion

A mortgage, as defined under Section 58 of the Transfer of Property Act, 1882, involves the transfer of an interest in immovable property to secure a loan or obligation. Each type of mortgage serves a specific purpose and caters to different borrower-lender needs. Case laws help clarify these provisions, ensuring their proper application and protecting the rights of both parties. Understanding these nuances allows parties to tailor their agreements effectively while complying with legal requirements.

Also, Check Out Other Topics in Transfer of Property Act:

Explore Law Shore: law notes today and take the first step toward mastering the fundamentals of law with ease.

After Completing my LLB hons, I started writing content about legal concepts and case laws while practicing. I finally started Law Shore in 2024 with an aim to help other students and lawyers.